Apple’s Sales Tainted by China Weakness and Trade War Worries in January

A Challenging Start to 2025 for Apple’s Stock

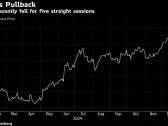

Apple Inc.’s shares have been under pressure since the start of 2025, with investors growing increasingly concerned about the company’s performance in the critical Chinese market. The stock has fallen for five consecutive sessions before rebounding on Monday, marking its longest losing streak since April.

Weakness in China Smartphone Data and Discounts

The downward trend can be attributed to several factors, including weak smartphone sales data from China, which analysts believe indicates a decline in iPhone shipments. Furthermore, a Reuters report revealed that Apple is offering discounts in China, further exacerbating concerns about the company’s market share and growth prospects.

"The Chinese market, important as both an end market and the heart of the supply chain, is vexing," said analysts led by Craig Moffett from MoffettNathanson. "Apple is not only losing market share among Chinese consumers but also faces a potential trade war that may mean the company, ‘integrated into China like no other American firm, might exhaust its political capital and still not completely avoid ill effects.’"

Tariffs and Competition from Huawei

The pressure on Apple’s stock has been further compounded by the risk of tariffs under the incoming Trump administration. While there is optimism that CEO Tim Cook will manage this risk, analysts believe that a worst-case scenario could add $256 of cost per iPhone.

In addition to the tariff concerns, Apple faces intense competition in China from Huawei, which has gained significant market share in recent years. The company’s valuation also appears elevated, trading at more than 32 times estimated earnings, above its long-term average and higher than the Nasdaq 100 Index at around 27 times.

Sales Growth and Revenue

The concerns about Apple’s performance in China are not new, with sales growth having been negative in five of the company’s past eight quarters. While estimates suggest that sales growth is expected to pick up next year, the pace is seen below that of other megacaps.

Apple’s most recent quarterly report showed a decline in China revenue last quarter, adding to concerns about its overall growth trajectory. The company’s dependence on China for both supply and demand has been a concern for analysts, with the region accounting for 17% of fiscal 2024 revenue, according to data compiled by Bloomberg.

Analysts’ Views

Cresset’s Ablin believes that Apple’s stock may not be among the top-performing stocks this year but does not see significant downside risk relative to peers. "I don’t expect this to be a top-performing stock among peers this year, but given the size of the installed base and its steady cash flow, I don’t see a ton of downside risk relative to peers," he said.

Other Tech News

- Nvidia rallied 3.4% on Monday to close at a record high of $149.43 ahead of CEO Jensen Huang’s keynote at the CES trade show in Las Vegas.

- Meta Platforms Inc. elected three new directors to its board, including Ultimate Fighting Championship Chief Executive Officer Dana White.

- Microsoft Corp. plans to spend $3 billion to expand its cloud computing and artificial intelligence capabilities in India.

Key Takeaways

- Apple’s stock has been under pressure due to concerns about the company’s performance in China.

- Weak smartphone sales data from China and discounts offered by the company have contributed to these concerns.

- Tariff risks under the incoming Trump administration and intense competition from Huawei are also weighing on the company’s prospects.

- Analysts believe that Apple’s stock may not be among the top-performing stocks this year but do not see significant downside risk relative to peers.